You can also cancel your GST registration by sending us a message. You need to return the GST of the value of the asset in your final GST return regardless of the accounting basis you use.

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

What happens if you.

. Close Information you need to close deregister your GSTHST account When you are ready to close deregister your. The form is processed by IRAS within 10 working days. Now click on the Services tab and then Registration option under Services.

A copy of bank statement to be attached with the application formHere is the step by step that could help you to understand how to register for GST in Malaysia. You cannot cancel your GST registration if GST is built into your prices even if your annual turnover is under 60000. All supplies of goods and services which are now.

The Royal Malaysian Customs Department Customs had previously issued the following Guides on matters relating to GST adjustments and declarations after 1 September. GST Registration Application Status. On submission of an application for.

Withdrawal of cancellation of registration application. You may cancel your GST registration if you are certain that the taxable turnover for the next 12 months will be 1 million or less due to specific circumstances such as termination of a high. Seal the validated original refund form in an envelope given to the tourist at the Approved Outlet and post it to the Approved Refund Agent to process the GST refund within 2 months of.

This can be done if you have been automatically registered for SST and your business does not generate any taxable. Businesses with separate branches or divisions If you are the parent. If you would like to deregister your business for SST you may do so by submitting an SST Deregistration requested to the Royal Malaysian Customs Department.

What does the MOF statement dated 16 May 2018 relate to the imposition of GST at 0 and its impact on GST. Enter the GSTIN Number. GST Registration Application Status.

It is collected on the value added at each stage of the supply distribution chain 4. The taxpayer registered under Goods and Services Tax GST however willing to cancel the registration may file an application in Form GST REG-16 for cancellation of GST. REGISTER LOGIN GST shall be levied and charged on the taxable supply of.

Open or manage an account Close 1. RM150000 RM400000. Apply for cancellation The process to apply for GST registration cancellation is possible via an online application form.

Go to GST Portal. GST is a multi stage tax and is imposed on most business transactions which take place in Malaysia. After the GST registration.

Check With Expert GST shall be levied and charged on the taxable supply of goods and services. Log in with your credentials. For tracking the status of your GST registration cancellation.

Navigate to the Services Registration Application for Cancellation of Registration option. Login to the GST Portal with your user-ID and password. Next you will see a drop-down from where you.

Taxpayer can withdraw hisher request for cancellation of registration till the time the authorized tax officer has not taken any action on. To cancel a GST registration an application must be submitted on the GST Common Portal in FORM GST REG-16 along with the required information. To compute his taxable turnover for GST registration purposes he needs to combine the taxable turnover for Business A and Business B.

Go to the official portal of GST.

Unimaginably Good Accounting Services In Singapore To Help You With Your Business Accounting Accounting Services Bookkeeping Services Audit Services

Profit And Loss Report Web Based Online Accounting Software Malaysia Online Accounting Softwa Online Accounting Software Accounting Software Create Invoice

Gst Rates In Malaysia Explained Wise

Https Www E Startupindia Com Blog 31st Gst Council Meeting Gst Refunds To Get Faster Easier 10278 Html Video Conferencing Indirect Tax Council

How You Can Contest Online Gst Penalties In Malaysia Blog Malaysia Contest Canning

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Hoping You Ll Love This Post Proton Ertiga Executive Manual Http Nazzjanggut Blogspot Com 2017 08 Blog Post Html Utm Cam Protons Electric Power Economical

Nspf Certified Pool Spa Operator Certification Program Spa Pool Pool Teaching

Sales And Service Tax Training In Ipoh Hrdf Claimable Vanue Aks Training Centre Ipoh Date 16 08 2018 Time 9 Training Center Ipoh Goods And Services

Gst Malaysia Goods And Services Tax Brake Pads Malaysia Cal Logo

Balance Sheet Web Based Online Accounting Software Malaysia Online Accounting Software Malaysia Online Accounting Software Accounting Software Accounting

Professional Tax Invoice Template Example Invoice Template Nz For Tax Invoicing Purpose When You Are Making Your Invoice Template Templates Invoice Example

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

Malaysia Sst Sales And Service Tax A Complete Guide

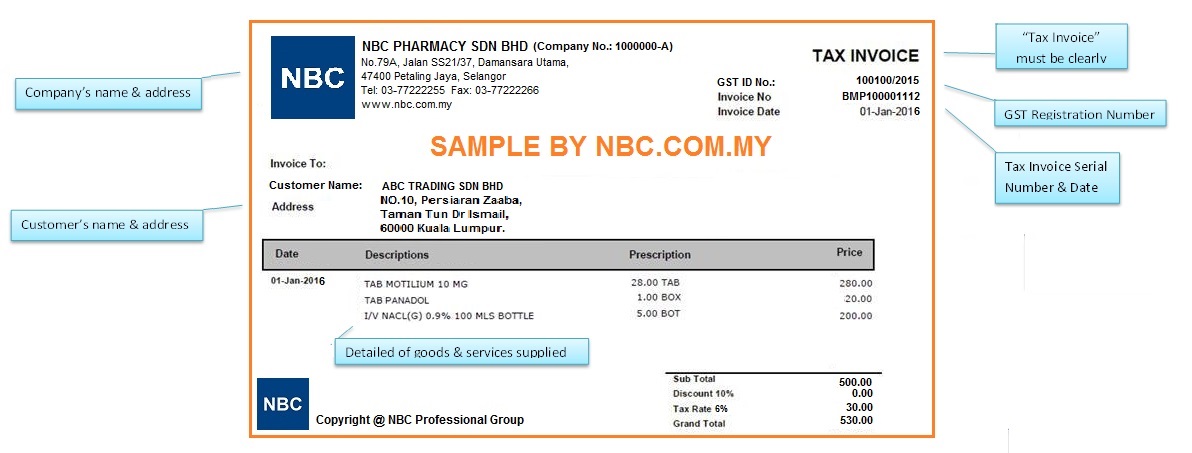

What Is Tax Invoice How To Issue Tax Invoice Goods Services Tax Gst Malaysia Nbc Group

Epenhcorp Cambodia Software Company In Phnompenh Provides The Most Stable And Easy Pos Soft Gym Management Software Hospitality Management Retail Software

Malaysia Gst Guide For Businesses

An Introduction To Malaysian Gst Asean Business News

Implementation Of Goods And Service Tax Gst In Malaysia Yyc